I partnered with Spectral in order to help imagine a world where borrowing and lending is done based on an on-chain credit score. During the three different design sprints I was heavily focused on understanding requirements from the team, and translating that into an intuitively designed and user tested experience.

Goal

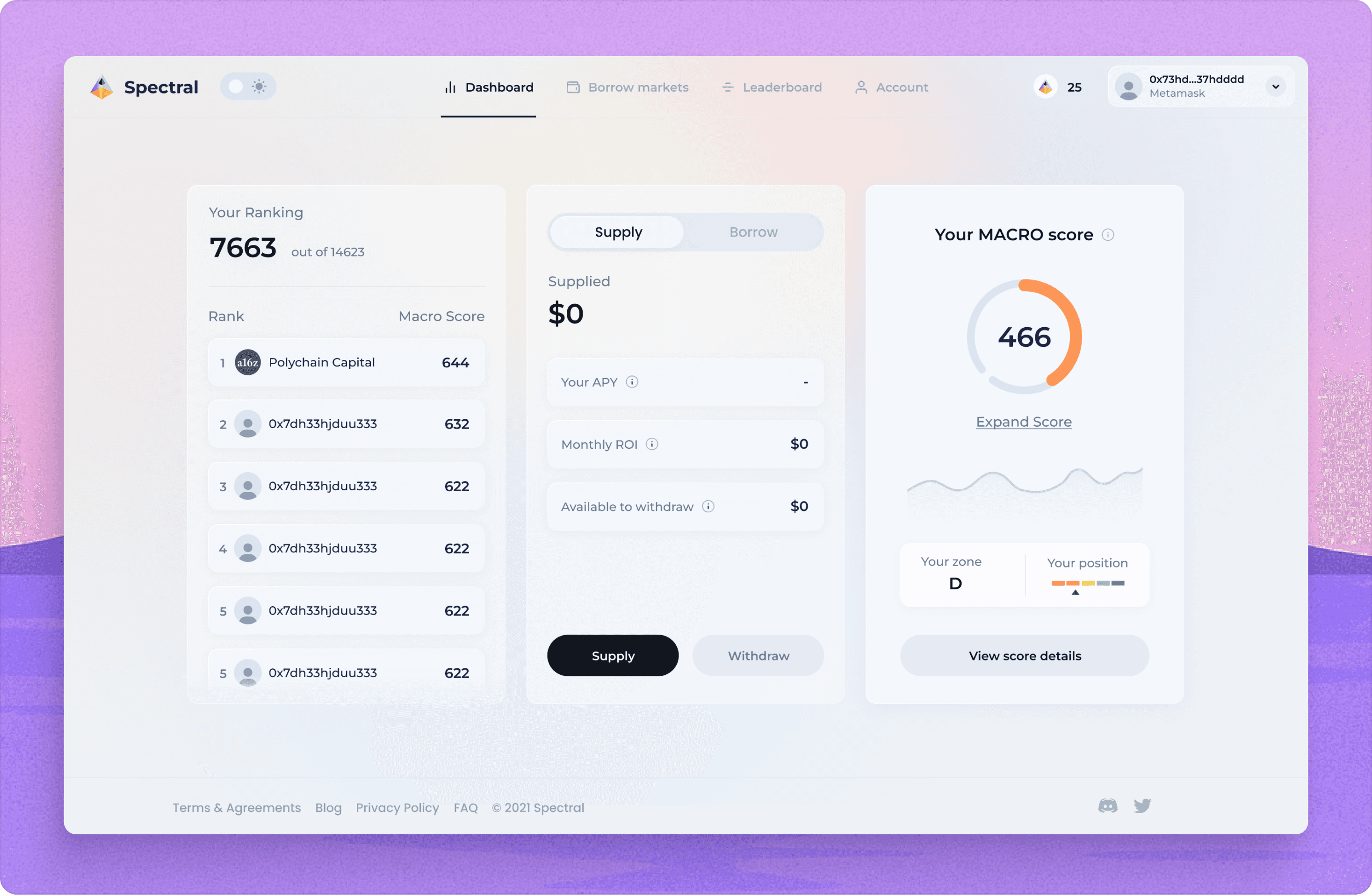

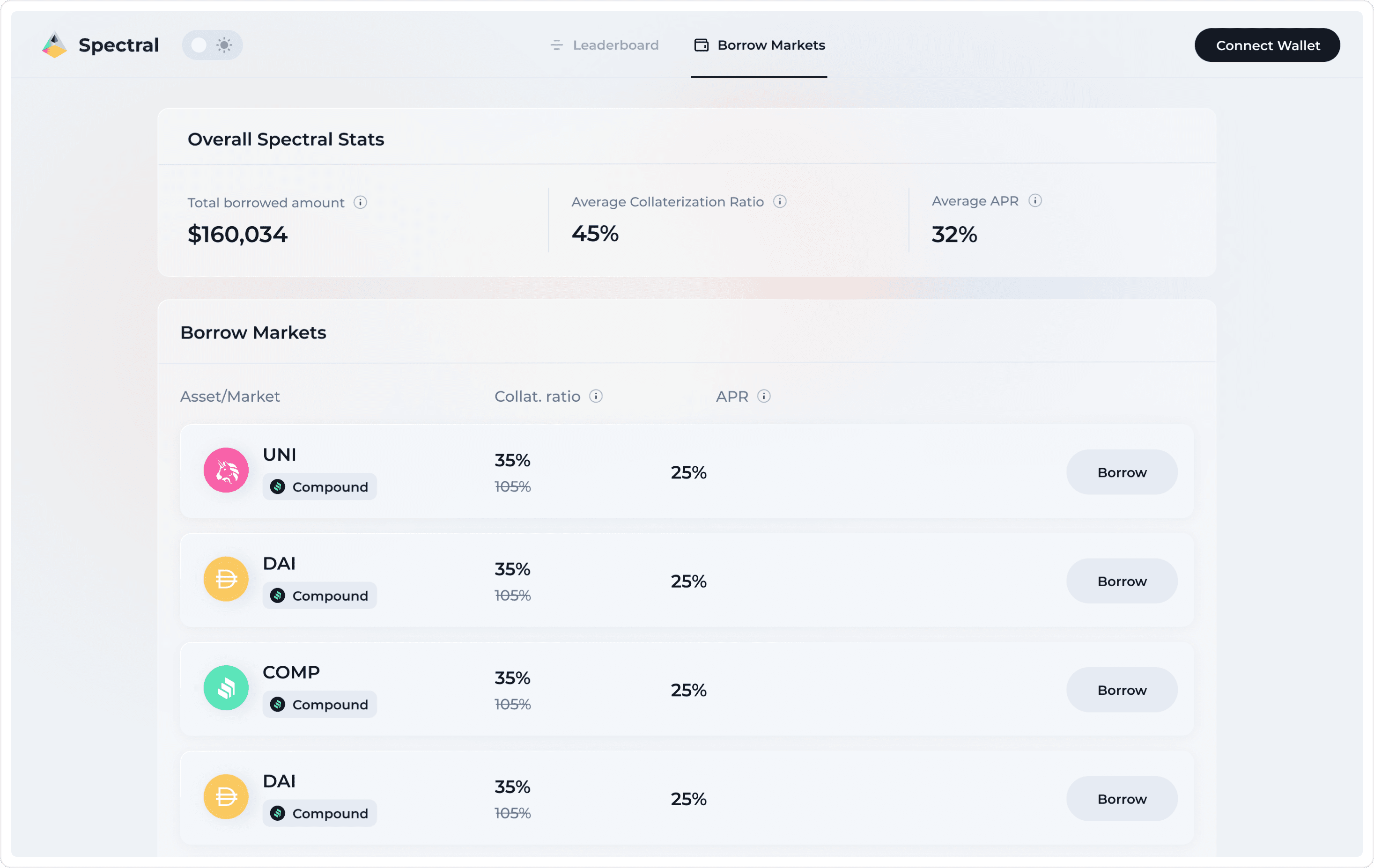

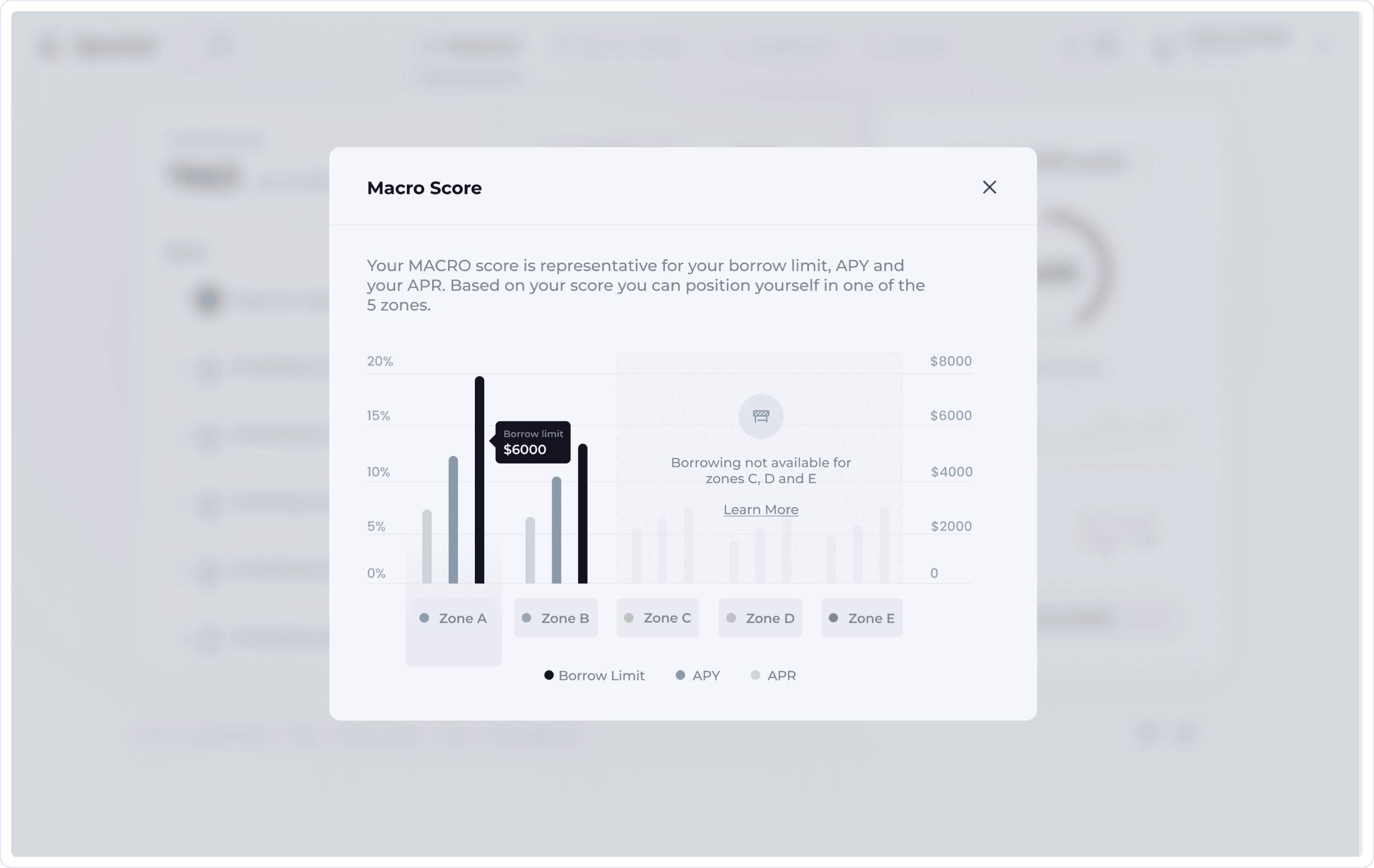

Spectral Finance helps build onchain credit infrastructure. They mainly focus on the Spectral MACRO Score, an onchain credit score associated to each blockchain address, helping lenders assess borrower risk. My main mission was to design a platform that would showcase the power of this technology, allowing users to borrow, lend and use their MACRO score as an NFT on other DeFi platforms.

Challenge

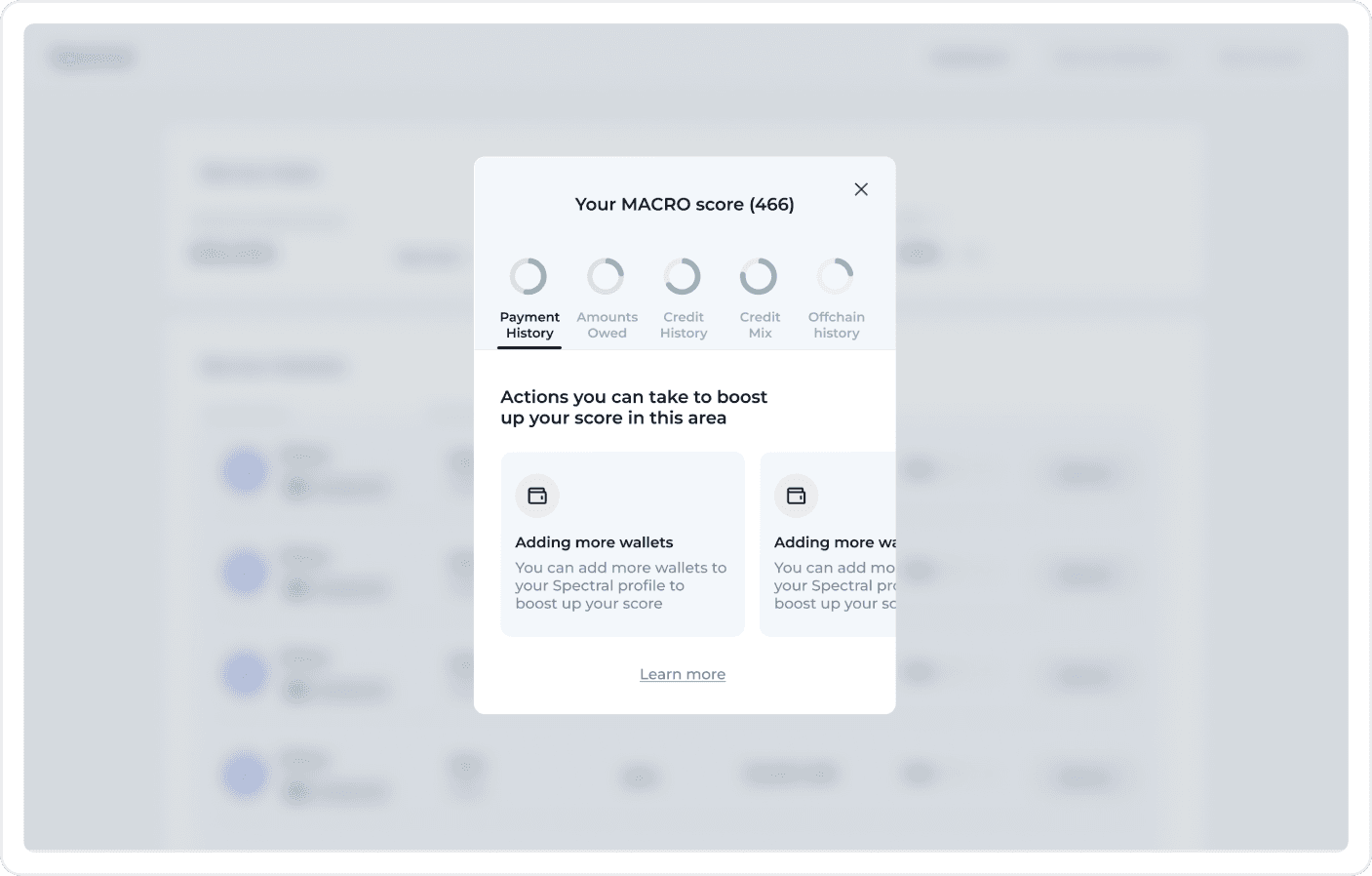

The main challenge was communicating what the MACRO score is and how users can improve it. The solution had to revolve around the score, offering a learn more section where users can inform themselves on how to improve this.

Solution

During the three different design sprints, I listened to the requirements of the Spectral team, designed prototypes and battle tested them with users in order to provide a friendly and intuitive experience that checked every goal.

Among many things, I've discovered that:

Borrowers wanted to see actions they can take in order to boost up the MACRO score

Borrowers wanted to see a timeline of how their MACRO score performed over time, including events that contributed to their score

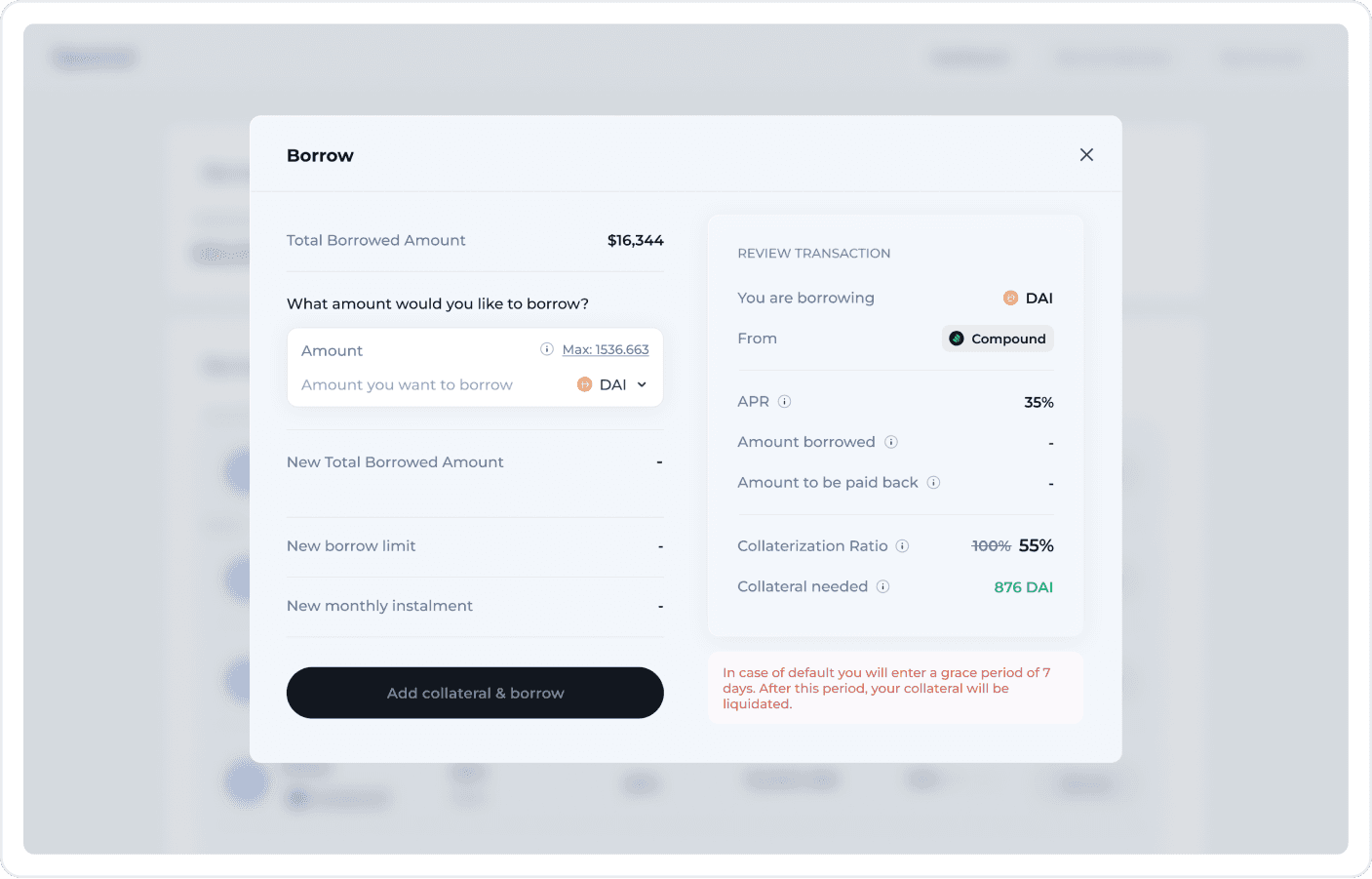

For lenders it wasn’t very clear how the loss was calculated in case a borrower defaults

I've solved these by:

Including an “Actions you can take” section where users were instructed on what they can do in order to boost their MACRO Score

Creating a graph detailing how their MACRO Score performed over time

Offering tooltips throughout the dapp, also focusing on information such as how the loss was calculated in case a borrower defaults

Results

After working together, Spectral went on and raised $23M

One week after the launch more than 200k users tested to see their MACRO scores

Delighted users through a beautiful UI experience

Earned users loyalty by listening and implementing direct feedback

Created a base for expanding the product through a solid design system

🚀

Result driven

Book a call with me